Barclays has always been virtually empty whenever I go in, same with Santander. Probably paying a huge rental with not much profit. More interested to know what’s gonna go in their place…especially as Home Accessories on the way out. Radical changes ahead (bout time really)

Indeed. A mix of independent and chain maybe?

Hoping its not too much more of the same, whatever it is.

If Santander and Barclays both go - do you think they’ll be taking their cash points with them? I always find them quite ha day for pulling some lunch money in the way to work

There are cash points at Sainsburys as well as the super sloooow dispensers at the station.

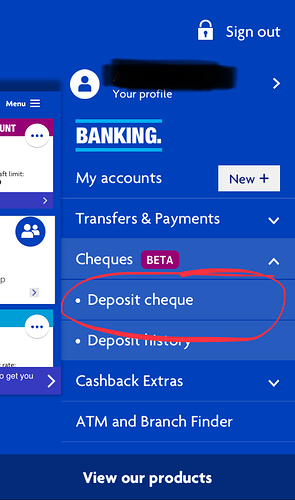

I wasn’t aware this was possible! Thanks for the info. Cheques only reason I go into bank branch.

gutted to hear Barclays is closing. I do neither telephone nor online banking so rely on the branch to do stuff other than withdraw cash.

also the staff there are lovely and I hate to think of them losing their jobs.

There’s a new service called cheque imaging that UK banks can now roll out. Halifax have quietly added it to their mobile app so you can pay cheques in by taking a photo of them through the app.

Remaining free cashpoints off the top of my head.

Sainsbury’s. (1)

Forest Hill Station (2)

There are also two in Dartmouth Road, one at the off licence next to Boots and another further up the road.

Co-Op (1)

Tesco Express/Esso (1)

Cash withdrawals can also be made at FH Post Office inside WHSmith, as well as deposits of which I think Barclays and Santander have signed up for. Cashback of up to £50 is available in Sainsbury’s.

As for online banking, my mother is with Barclays and while being elderly, she uses me to help transfer money between accounts and do bank transfers. However, it does seem unfair for those who rely on that service to either use the PO for basic banking and for more complex issues at Sydenham, Catford or East Dulwich.

Barclays have a pilot scheme for cheque imaging - https://www.barclays.co.uk/ways-to-bank/mobile-banking-services/mobile-cheque-imaging/

Apparently all UK banks will offer this by the end of the year. You learn something new every day.

This pattern certainly heralds a sea change, ultimately the death of cash IMO.

It will still take a while for that to happen. In the meantime, this is bad news for the local area (Crofton Park branch is closing also). It will disproportionately impact the elderly, disabled and small business. Interesting report on this here:

http://researchbriefings.files.parliament.uk/documents/SN00385/SN00385.pdf

The impact on access to finance is troubling. The model of taking a slice of income from small business for processing cards needs to change also. If electronic is the new more efficient form of cash then it should be treated as such. But why would the banks do this if it dents their profit?

The Post Office do have counter serivce arrangements with most of the banks. This is true for sub post offices too. The problem there is that they can be less obliging about it. I have recent experience where a PO counter made a fuss about taking change that was bagged up (and within the allowed limits). At the end of the day, these are small businesses too and are now having to take the brunt of these transactions.

As a small business owner in SE23 this is bad news. I have to pay cheques in from a US client fairly frequently and having the option of walking five minutes to the branch to do it is very convenient particularly as the process of paying it in can take 10 minutes of form filling.

Seems that all the cheque imaging schemes are for sterling cheques only so even that won’t help.

Everything is going! I asked in branch when it was first announced.

I was just about to say that when we lived in the US you could deposit a check (yes thats how they spell it) by taking a photo. Chase had an early iPhone app that allowed this. I wonder why it took so long here…

Typical of our cousins across the pond.

However this spelling aligns better with the old Morecambe and Wise joke about how tight Ernie was with money and his endorsement of how their guests were paid by the BBC - with small checks.

I know I know - don’t write to me - write to the BBC - they broadcast it.

My main concern is how the hell do us shops get small change from notes without any banks.

That’s just from a shop and not a resident point of view, so may be selfish of me to ask.

But it is a concern. For all shops and businesses.

This is what I feared. Any idea of how many others from the FH traders this will affect?

Not selfish of you at all. From my experiences in my own bank in Sydenham, a lot of traders use it still, which is got me wondering.

Hope you all find a solution.

Probably because very few people use cheques. I’ve lived in the UK for almost ten years, and have never written or deposited a cheque.

I wouldn’t be too quick to credit the Americans with advanced payments tech. They’ve only just begun to roll out EMV (chipped) cards and even then most still require the less secure chip ‘n’ signature rather than chip ‘n’ pin. Contactless payment, other than through 3rd party apps like Apple Pay is almost absent.

Yes. That exactly why they rolled out check deposit via image ages ago - because Americans still write checks.

I agree, plus cheque imaging is an additional cheque clearing system in the UK rather than just adding a feature to the existing system. Cheque imaging will clear cheques faster than the existing UK cheque clearing system, which will continue to run in parallel.